The Woonivers model

We are creating a digital experience that eases the Tax Free incentive so our travelers can save money and time.

- First

- Second

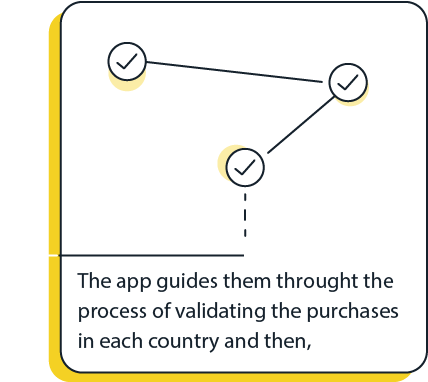

- Third

- Fourth

- Fifth

1/5

2/5

3/5

4/5

5/5

Where are you travelling?

Once you scan a ticket - the app will display your instructions.

Each country has a different regulation and process but dont Worry, Woonivers will give you the instructions for every case.